This post title comes from a criticism my mom used to give me whenever I was oversharing, overly trusting and too vulnerable with my friends as a teenager.

“It’s fine to tell them a little, but you don’t need to bare your soul,” she would emphasize.

More often than not, I regretted not taking her advice. As an adult I realize that revealing your own weaknesses doesn’t keep other people from poking fun at them.

I kept thinking about this while reading Mari Okada’s biography, as translated by the talented Frog-kun. In From Truant to Anime Screenwriter: My Path to “Anohana” and “The Anthem of the Heart” (affiliate link), Okada wastes no time putting all of her flaws on display.

Okada describes her adolescence using all the trappings of anxiety and depressive disorders, but without giving herself a diagnosis. It’s clear that her avoidance of school is an extreme reaction to facing the fact that she can’t control what other people think of her.

“Whenever I came to study,” she says of a driving course she took in high school, “I always brought along earplugs. I did this because it would hurt whenever I thought people were gossiping about me. This meant that I couldn’t hear the lessons at all.”

Throughout the book, Okada describes her peculiar habits born of anxiety, like peeling off her fingernails and refusing to bathe for days. In her 20s, she began dating somebody for the first time. “I was afraid of what would happen if he overestimated me… The answer I arrived at was to leave open the toilet door and do my business in front of him. If he didn’t hate me after that, then I could believe his affection was genuine.”

Just like showing her bodily functions to a romantic partner, writing about the most repulsive aspects of herself—the ugly side of anxiety—is Okada’s coping mechanism to deal with what she can’t control: in this case, readers’ reactions to the book. By drawing attention to the things she is most ashamed of, she’s trying to beat us to the punch.

Unfortunately, as Okada’s narrative continues, it becomes apparent that neither hiding yourself at home nor revealing absolutely everything is enough to control how people feel about you. After one of the first anime she writes for airs, Okada decides to (cue ominous music) read the comments:

“My chest was pierced with shock. I couldn’t breathe. My eyes were fixed on the words written there: ‘Piece of shit writer. She should just die.’ … This wasn’t like the persecution complex I had in my truant years, when my mind inflated the negative aspects of every little thing. These were words that were right there on my monitor… Somebody wanted me to die.”

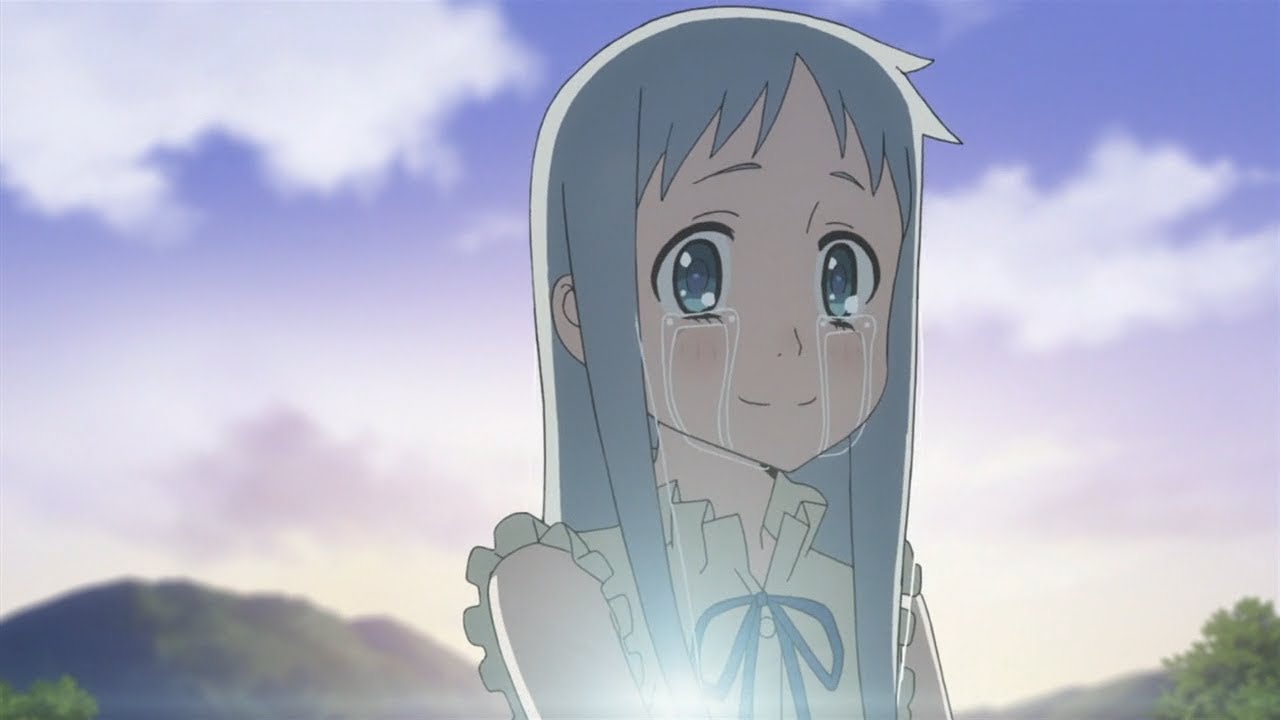

Despite her self-professed lack of confidence, this amazingly doesn’t keep Okada from writing or even from reading more comments. Later, she draws strength from positive feedback about her most personal title to date, the truant-focused Anohana. These comments mean a great deal to her because, like the boyfriend who accepted her after seeing her use the bathroom, these fans love a narrative that includes the worst parts of her. In the end, Okada realizes that to reach her goals, she needs to work around her anxiety: “I wanted to become an anime writer. To make it happen, my overly self-conscious nature could bug off.”

Okada’s story is one every creator should read. As somebody who writes fiction and fanfiction under a pseudonym I will hardly tell anyone, somebody who can’t bring myself to read the comments on my Anime News Network reviews, I realize Okada’s success story requires a great deal of personal strength and far more courage than she gives herself credit for.

It’s oddly comforting to read about Okada’s hangups when contrasted with the enormous emotional impact of her body of work. Faced with the futility of never be able to control how she or her work is received, Okada simply writes from the heart. If I do it while remembering I won’t be able to please everybody, maybe it’s OK for me to write with my soul bared, too.